Founders Life and Health Blog |

Medigap Plan N vs Plan GAre you looking at a Medicare supplement plan and trying to figure out what letter plan is best for you? Today, we are going to be looking at plans N and G, and comparing them in a very short, quick little summary on the differences between the two. So hopefully you can make the choice that's best for you. Medigap Plan N vs Plan GHi, my name is Jo Hutchison and I am a health and Medicare advisor with Founder's Life & Health. We are based here in beautiful St. Louis Missouri, but we work all over the country and our services are free to you. So today we are talking a little bit about Medigap plans and comparing plans, N and G. And I am going to make this a very short summary so that I don't bore you to death with all the ins and outs, but here are the basic details of the differences between the two. So what are the differences between a plan N and a plan G? Well, there are going to be two main differences.

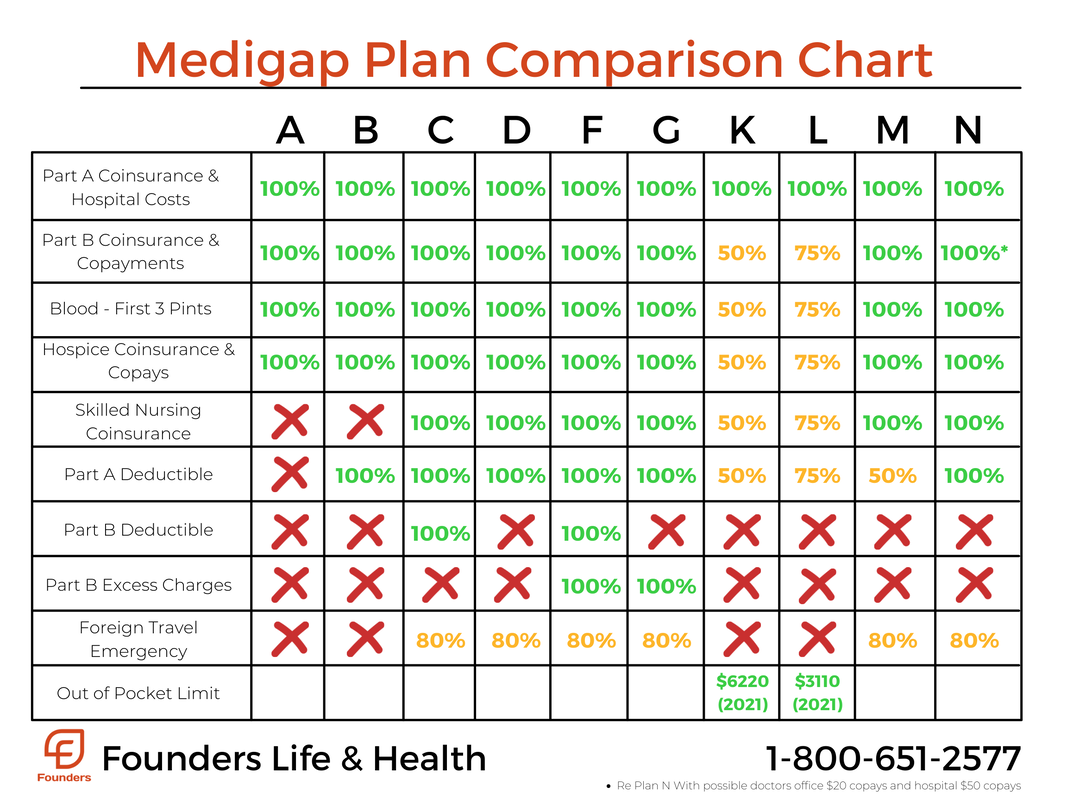

One of the only things that it's not going to cover is going to be your part B deductible, which none of the plans will cover that unless you are eligible for Medicare before January 1st, 2020. If that's the case, you would be eligible for a plan F but we're not talking about F today, we're only talking about N and G. Now, let's look at a plan N. What is going to be left off of a plan N well, that part B deductible just like in G, and there's two other things that we need to look at with a plan N.

Ready to do some math? Here's where the math comes into it. If you're considering a plan N, what you need to do is look at what the premiums are going to be for your plan G versus what the premiums will be for your plan N. Consider whether or not any of the doctors that you absolutely must see do or do not take Medicare assignment, and then do a little bit of research in advance to figure out if you think that the savings are going to make sense to go with a plan N that will offset the cost of whatever doctor copays you're going to have, then it could make good sense for you. But you can talk to your Medicare advisor, look at each plan side-by-side the premiums are going to be different in every area. So you need to get specific about what plans are available to you and your area based on your age and where you live. So hopefully that was helpful, like I said, I wanted to keep it short, sweet and to the point. If you have more questions about any of the Medigap letter plans or anything else Medicare related, please don't hesitate to reach out. I am always available. Thanks for reading. About the Author

0 Comments

Leave a Reply. |

Contact Us(800) 651-2577 Archives

October 2023

Categories |

Navigation |

Connect With UsShare This Page |

Contact Us |

Location |

RSS Feed

RSS Feed